ESG Deposits is an innovative, modern deposit solution for businesses. It allows you to place your business’ surplus liquidity into a time deposit that factors in ESG criteria. This way, you contribute to sustainable development projects, actively demonstrating your commitment towards a low-carbon and sustainable environment.

Choosing investments factoring in ESG criteria

We use funds raised under ESG Deposits to finance projects that promote sustainable development, driven by the ESG criteria (Environmental, Social, Governance).

All projects meet the eligibility criteria set out in the Eurobank Sustainable Finance Framework.

Information on our investment portfolio

We regularly monitor fund allocation for our entire investment portfolio funded through the ESG Deposits.

We aim to use the funds collected under ESG Deposits to finance specific sustainable development projects, within 3 months from the day you deposited the amount.

Discover how we have allocated our total ESG Deposits portfolio.

Place a minimum amount of €300,000 for 3, 6 or 12 months. You can receive a certificate on the cash balances you have invested.

Fixed term of 3, 6 or 12 months

You may place your cash for a fixed term of 3, 6 or 12 months in a new time-deposit account, which we open specifically for your ESG Deposits.

If you need to draw back funds before the maturity of your time deposit, you may make an early partial or full withdrawal. However, we ask that you inform your Relationship Manager at least 31 days before the potential withdrawal. Your capital is guaranteed in all cases.

Capital and interest paid at maturity

The interest rate is fixed over the entire term of your time deposit. Capital and interest are paid at maturity.

If you wish to open a new ESG time deposit, contact your Relationship Manager to find out the current interest rates.

ESG Deposits certificate

Upon your request, you can receive a certificate on the cash balances you have placed in ESG Deposits.

This way you may easily include your ESG time deposit in your sustainable development agenda.

ESG Deposits availability

ESG Deposits are available for you to place your surplus liquidity until we raise the total amount we need to cover our targets.

To find out if ESG Deposits are currently available, contact your Relationship Manager.

70+ businesses support sustainability

ESG Deposits was launched in December 2021, aimed at Eurobank corporate clients. More than 70 Greek businesses have placed capitals in the time deposit at least once. This way they actively demonstrate their ESG agenda.

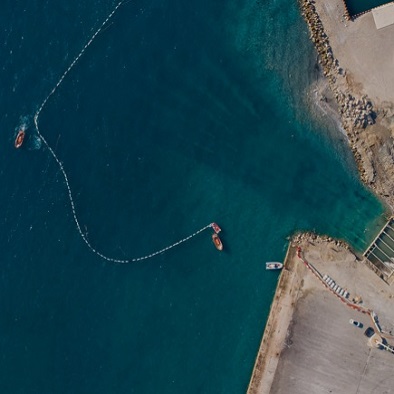

ESG Deposits allocation

We successfully allocated the funds raised through ESG Deposits to green and sustainability-linked loans that meet Eurobank's Sustainable Finance Framework criteria.

55% of the allocated funds have financed loans in the accommodation sector, 20% in water transport, 11% in electricity production from alternative resources, while the rest were allocated to other sectors.

Sustainability-linked loans offer incentives to borrowing customers to assist them in implementing their sustainability strategy. These loans include sustainability performance targets (SPTs) that need to be achieved for the customer to keep enjoying the favourable loan terms. For our ESG-Deposits loan portfolio these SPTs are:

- CO2 emissions reduction.

- Energy efficiency.

- SPTs related to circular economy.

With ESG Deposits you directly contribute to projects that promote a sustainable future, while you also do your part for the environment. Specifically, your money is allocated to projects focusing on activities that benefit the environment.

In addition, you align your investment strategy with initiatives that promote the common good and you demonstrate your commitment to sustainability. This way you meet the expectations of your customers, employees and investors.