As part of our ESG strategy, we are committed to improving existing and introducing new sustainable product offerings. This way we aim to support our clients’ transition to sustainable practices and business models.

Our sustainable financing performance

Green Bond Framework

Through our Green Bond Framework, we are committed to supporting our ESG strategy, financing projects that bring environmental benefits.

The Eurobank Green Bond Framework:

- Outlines the principles under which Eurobank issues Green Bonds.

- Describes how the Eurobank Green Bond supports and contributes to achieving the UN Sustainable Development Goals (SDGs).

- Aligns with the ICMA Green Bond Principles, the draft EU Green Bond Standard and the Regulation (EU) 2020/852 (EU Taxonomy Regulation), on a best effort basis.

- Received a Second Party Opinion from Sustainalytics.

Sustainable Investment Framework

Committed to being transparent about our ESG approach, we developed our Sustainable Investment Framework, which outlines the classification process and approaches for selecting investments with sustainable features and monitoring the sustainable bond portfolio of our banking book.

Sustainable financing and investments for corporate clients

Having a leading role in the largest, most prominent projects in the Greek economy, we finance robust business plans, growth strategies, investment programmes and export activities in strategic sectors.

We coordinate and raise capital for a series of landmark initiatives:

- Hellinikon project – A flagship project of major significance for the Greek economy.

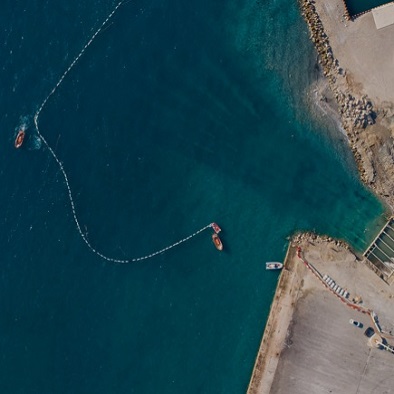

- Electrical interconnection between Crete and Attica – A flagship energy transition project for Greece, putting into practice a vision of decades. Eurobank is participating in the financing with €200 million.

- Renewable Energy Sources (RES) – Sustainable projects totalling €0.7 billion.

Find out more about our investments in landmark projects.

Sustainable financing for individuals and businesses

Green lending

We are currently offering several consumer and small business financing solutions that are compliant with the EU Taxonomy Regulation:

- Electric car loan – Enjoy more favourable loan terms when buying an electric vehicle. Special arrangements when buying a TESLA car.

- Energy Saving and Autonomy – Up to €50,000 per home, to improve the building’s energy efficiency, to achieve energy autonomy, and to install smart home automation systems and electric car charging points.

- Bridge Financing for Energy Saving and Autonomy – Credit facilities for constructors undertaking energy improvement projects that fall under the Energy Saving and Autonomy programme launched by the Greek Ministry for the Environment and Energy.

- Financing for solar panels – Small business loan, financing up to 70% of total installation cost for new solar (photovoltaic) parks with a minimum installed PV capacity of 10kWp.

- Leasing for solar panels – Financing the photovoltaic equipment to be installed on land owned by the business.

Social lending

Committed to support entrepreneurship and innovation we provide financing solutions with a social impact:

- Startup ecosystem –Working capital and equipment loans for startups participating in the egg – enter•grow•go incubator.

Asset and wealth management with ESG criteria

In 2018 we launched the (LF) Fund of Funds – Next Gen Focus, a mutual fund that invests in shares and bonds factoring in the ESG criteria.

Deposit solutions with ESG criteria

In 2021 we launched the ESG Deposits. This is an innovative deposit solution for businesses seeking to place their excess liquidity in financial products with ESG features. We use the funds raised to provide wholesale lending that meet the criteria set out in the Eurobank Sustainable Finance Framework.