Download the Eurobank Mobile App on your mobile for free:

Through the Eurobank Mobile App

Download the Eurobank Mobile App on your mobile for free:

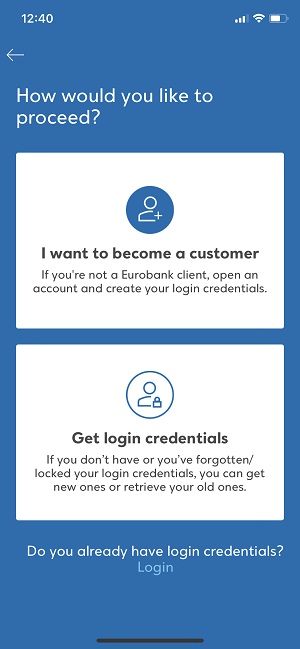

Open the app to sign up. Your screen displays your available options.

If you do not bank with Eurobank, to open an account for your day-to-day transactions:

- Choose: Open an account

You will need just a few minutes to complete your application. You do not have to come to a branch.

To be able to monitor the progress of your application, you need to allow the app to send you notifications.

If you fail to do so at the time, you may turn them on later through your phone Settings.

To open an account online through Digital Onboarding, you must:

- Be a permanent resident in a country participating in PRADO.

- Work in a country participating in PRADO.

- Have an ID or passport issued by a country participating in PRADO.

Fill out your mobile number

The first step to opening an account is to fill out your mobile number.

To verify it, you enter the One-Time Passcode (OTP) you receive via SMS.

Upload the supporting documents

The next step is to submit all supporting documents required. You must upload the original documents or clear photos, but not screenshots:

- For proof of identity – take a headshot on the spot and a photo of your valid passport or other document proving your identity.

- For your income and profession – choose your professional status, i.e. salaried employee, self-employed, student, etc. and upload the supporting documents verifying your income and capacity.

- For your home address – we need to know your address to send you your debit card by post.

Once you submit all required documents, wait for 5 minutes for us to check them. If necessary, we may ask you to resubmit some of them.

Find out the supporting documents required for your application.

One of our representatives contacts you

Once we check your supporting documents, we contact you by video call to verify your personal details. Keep the app open while we check your documents. If you close the app before the video call starts, you will have to start over.

The video call takes about 3 minutes. Just before it starts, you receive a notification. The camera turns on automatically to talk to our representative.

Get your login credentials

Once the video call is concluded, you get issued with login credentials for e-Banking and the Eurobank Mobile App.

Choose the Username and the Password you want.

Choose how you wish to bank with us

To complete your application, read and accept the terms and the pre-contractual information document for your account.

Your account and debit card number appear in the terms, which you have accepted.

To better serve you with products and services that meet your needs, you also need to answer a few questions about:

- Your financial profile.

- The transactions you wish to carry out through us.

Once you have answered these questions, your application is completed.

Get updated by SMS

Regarding the outcome of your application, you get updated by SMS on the mobile you have registered.

You receive the SMS within 15 minutes to 2 days following your application. Provided we approve it:

Proof of identity

Take a photo of and submit your valid passport to prove your identity.

If you have no valid passport, take a photo of and submit your ID card (front and back).

Proof of income and tax details

Upload a pdf file or a photo of the income tax return statement (latest), issued by the tax authority of your country of residence.

Proof of employment

Upload a pdf file or a photo of the supporting documents for your profession.

If you are a salaried employee, a certificate from your employer, your most recent payslip, a certificate issued by the competent social insurance fund or any other official document proving your professional status.

If you serve in law enforcement or the armed forces, your uniformed services ID card or any other official document proving your professional status, as well as your most recent payslip.

If you are a freelance professional or farmer, a document certifying your profession, such as:

- A certificate issued by the competent social insurance fund proving your professional capacity (issued within the past 3 months).

- Any other official document proving your professional capacity.

If you are a student, your student ID or any other official document proving your student capacity.

If you are a pensioner, your most recent pension slip, a certificate issued by the competent social insurance fund or any other official document proving your professional capacity.

If you are unemployed, an official document proving your professional status.

Proof of home address

To receive your debit card by post, we need to know your home address to send it.

You should submit a recent utility bill or a mobile phone bill (issued within the past 6 months).

The Day to Day Account allows you to easily:

- Make payments, transfer cash and shop by directly debiting your account.

- Monitor its activity on your computer or mobile.

Find out how your day-to-day life gets easier with the Debit Mastercard.

Sent to your address

You receive your debit card by registered mail at the address you indicated in your application.

Along with the card you also receive your card PIN.

Activating your card

You can activate your Debit Mastercard at any time before its expiry date:

- Online with Cards Control through the Eurobank Mobile App or e-Banking – if you already have login credentials.

- Through EuroPhone International Banking – Call on +302109555345.

€pistrofi loyalty programme

Your debit card is linked to the €pistrofi loyalty programme. You don’t need to register for it.

Use it to earn and redeem cashback rewards through transactions at over 8,500 retailers in Greece.

To open your account as fast as possible, make sure to:

- Upload the original documents or clear photos of your supporting documents, but not screenshots. If we cannot read them, you will have to repeat the process.

- Keep the app open while we check your documents (max 5 minutes). If you close the app before the video call starts, you will have to start over.

No, you can’t.

To open another account or apply for other banking products, call EuroPhone International Banking on +302109555345.